What is Lendroid ?

Lendroid is a non-rent seeking, trust-independent, open protocol enabling decentralized lending, margin trading and short selling on the Ethereum blockchain. It aims to solve the shortcomings of centralized exchanges by creating a global shared lending pool, and a symbiotic off-chain infrastructure supported by incentivized participants - Relayers and Wranglers. Simply put, Lenders contribute their offers to the lending pool through relayers, who then match the offers with appropriate traders. The traders can use the borrowed funds to margin trade, make a profit, and repay the lenders.

The lender is the primary participant on the Lendroid platform. The protocol’s soundness is validated only by his sustained, profitable participation. The lender’s trust in the trust-independent protocol will power the creation of a global lending pool. To this end, innovative rules and fail safes have been put in place to not let down his basic expectations of protecting his capital and earning risk-free interest in a low-friction manne.

In point of fact, Lendroid was initially intended as a decentralized lending platform. Broadly, the process was designed thus: A borrower pledges digital assets into an escrow account, and the lender defines specific terms for the loan amount, interest rate, loan period, loan to value (LTV) set in a smart contract. If the lender’s and borrower’s terms match, the smart contract is executed, locking in the collateral and releasing the funds to the borrower. If the borrower satisfies the loan obligations, his collateral is unlocked automatically. If the borrower defaults or the collateral drops below the agreed LTV, the collateral is liquidated.

The trading margin seems to be the first sensible use case for Lendroid for two main reasons as follows:

1. The Market Grows Fast

Boundary funds have soared, as noted by some widely used bourses such as Poloniex and Bitfinex. At the last exchange, USD funding increased from 14.8 million to 168.5 million (October 2016 through October 2017); The BTC loan has been changed from USD 6.12 million to USD 183 million (October 2016 through Sep 2017); and ETH loans increased from USD 834,192 to USD 88.29 Million (October 2016 through Sep 2017).

2. Need for Trust Independence is Immediate

Centralized exchanges allow border trading to be left with double responsibility and tight funds and guarantee management while keeping traders from failing. To provide this service, it can be argued that centralized exchange has passed through the inherent strength of the blockchain ecosystem based on decentralization, absolute protection and anonymity through global consensus.

A decentralized margin trading protocol a platform that is censorship resistant and can be accessed globally would help move away from central custodians holding user funds. Further, a global network of lenders will increase liquidity and reduce overall margin trading costs.

A borrower can receive Ethereum based (ETH/ERC20) tokens (like ETH, USD-DC, etc.) by pledging some other Ethereum based tokens (like REP, SNGLS, DGX, DGD, etc.). The borrowed tokens come from lenders who expect to receive interest at a rate they choose.

Ecosystem synergy :

Lendroid makes no sense in the absence of other DApps and tokens on the Ethereum platform. But in combination with other DApps, the real power of the Lendroid can be realized. A few examples:

* Lendroid + Melon = Allows traders to leverage their positions, allows traders to hold a short position.

* Lendroid + Stabl / Decentralized capital = Allows users to avail loans against any Ethereum token in stable government currencies.

* Lendroid + Digix = Allows users to avail loans against physical assets in any Ethereum token.

* Lendroid + Digix + Stabl / Decentralized capital = Allows users to avail loans against physical assets in stable government currencies and more.

How Lendroid works ?

A loan contract itself is pretty straight forward. But then, who fixes the terms of the loan? How do borrowers find and convince lenders? How do we make sure the borrower has the incentive to repay? What happens if the borrower fails to repay? etc

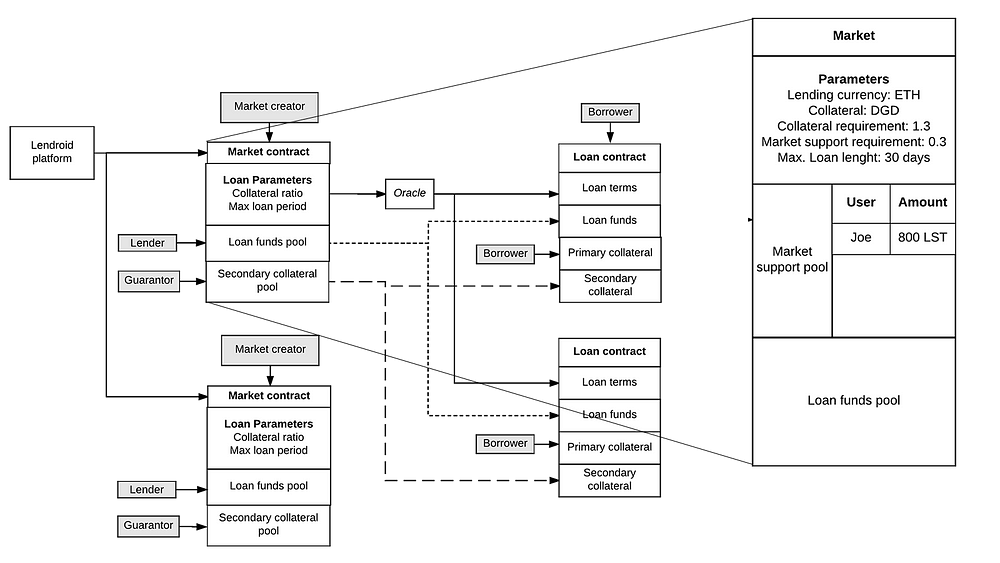

The Lendroid marketplace allows the creation of several loan markets.

Lendroid support tokens(LST) are the native tokens of the Lendroid protocol. Market creators (Lendroid support token holders) propose new markets using a unique set of loan terms (combination of collateral type and ratio).

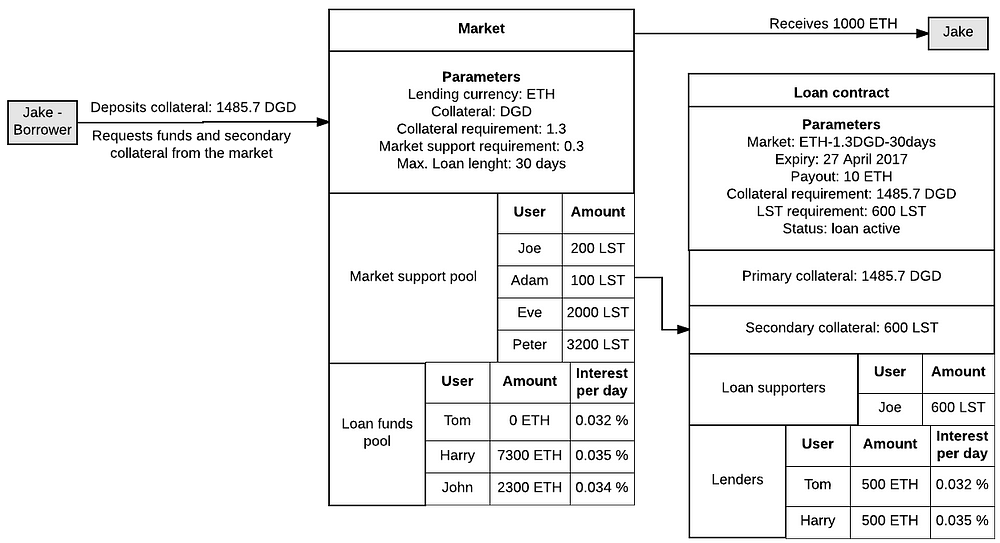

Lenders and guarantors discover, gather and pre-fund markets which offer loan terms they prefer (terms that they believe will keep the loan solvent, protect their investment and enable them to make money). Guarantors are LST holders who choose to extend support to markets that issue loans that they believe will remain solvent and payout properly, in which case they receive a portion of the interest. If the loan becomes insolvent, they stand to lose their deposit. It is a requirement for every loan to hold LSTs whose value is at least 20% of the borrowed value. The LST deposit acts as secondary collateral for the loan.

Borrowers show up, choose a market depending on the type of collateral they wish to lock, create a loan contract, deposit collateral as defined by the terms of the loan and receive the loan funds.

At the end of the loan period, the borrower has the option to extend the loan by adjusting the collateral locked or repay the loan along with the accrued interest, or stands to lose their collateral.

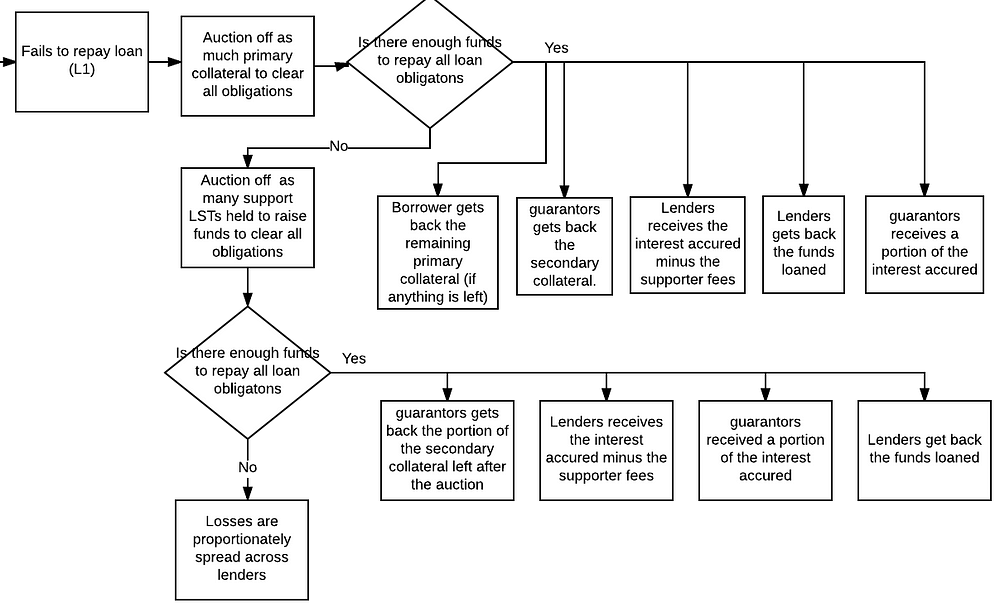

If the borrower fails to repay the loan, the primary collateral held in the loan in auctioned off. If the funds raised in the auction is insufficient to clear all obligations as much secondary collateral (Lendroid support tokens) is auctioned off to raise additional funds. If even after auctioning off all secondary collateral locked in the loan there are not enough funds to repay all the lenders, the losses get spread proportionately across all lenders, and the lenders are paid out.

The lenders receive two layers of protection for the funds they lend. One from the value of the primary collateral and another from the value of the secondary collateral. This process increases the confidence of lenders and reduces the lender’s market discovery burden.

Lendroid Support Token

- Rate : 1 ETH is 48.000 LST

- Bonus : 25% of TGE tokens reserved for pro-rata distribution among contributors who optionally vest for 2 years.

- Hard Cap : 5.000 ETH

- Token Supply : 12.000.000.000 LST

- Released in Public TGE : 240.000.000 LST

- Accepted Currency : ETH

Allocation Funds

Roadmap to Token Lendroid

In Q1 of 2017, we released Whitepaper on Decentstalized Digital Asset Lending and in Q2, a loan for the ENS demo was launched in Kovan.

The Team

More detailed information as follow :

Posted by Dico88

Tidak ada komentar:

Posting Komentar